|

Maybe it is the umpteenth snowstorm this year or the plethora of tax related document appearing in my mailboxes or having just paid my property taxes that have turned my thoughts to “death and taxes”. The good news is that being snowed in is the perfect time to review the records that we’ve collected and think of collateral information that will help flesh out our family story. And surprisingly, taxes are a useful source. Let’s look. When beginning family history, we are searching for the basics but as we grow and expand our research, we discover the smallest tidbit of information will help us. Tax records for land can provide us with information about place, dates and income or wealth. They may be some of the few documents that tell us how well our ancestor was doing. Or that they were farming or living in a location and when. Or that they lost land because they couldn’t afford to pay the land taxes. All these paper trails tell us more about what was happening in our ancestors.

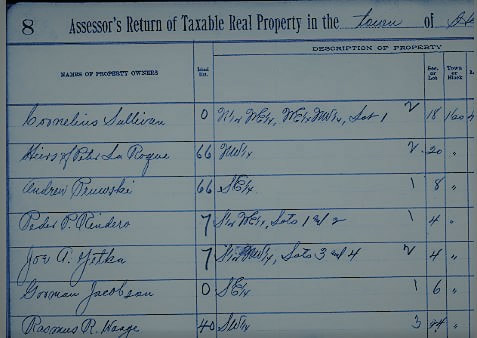

Finding tax information can be a treasure hunt. Here are a few resources that I have found useful. Tax Records I was not looking for tax information when I stopped at a local research center in Roseau County, Minnesota a few years ago. Much to my surprise they had copies of land taxes records from the early 1900s. These records were called Assessor’s Return of Taxable Real Property of Township. These records provided the following: name, school district, land description as well as section and number of acres, land value, taxes due and when paid. It also included a listing and value of furniture, livestock and farm machinery. These are great documents that tell us how our ancestors are doing and what things they owned related to their farm. Will every historical society or regional research center have this information? No. In my opinion, these old tax records get transferred from the township or county because there isn’t room any longer at the court house or because of their age, they aren’t considered relevant anymore and packed off to long term storage. It’s worth the effort to check with your local historical society or court house to see if that information is available to view. Personal Income Tax If you have any personal income tax information for an ancestor, it might be related to the death of a spouse and that first tax that was filed. These papers can give you an idea of how the family was doing but would not be readily available to the general public—just part of your own personal stash of family papers. Treat them with respect and use to create context in your family story. Online Tax information Ancestry.com has tax records. A quick search of “taxes” provides a list of tax related records for various locations. If you have an ancestry.com subscription, it is worth checking out. One example of tax records: Ancestry.com. Sutton, Surrey, England, Tax Collection Rate Books, 1783-1914 [database on-line]. Provo, UT, USA: Ancestry.com Operations, Inc., 2016. Original data: Rate Books. London Borough of Sutton, Sutton, England. FamilySearch.org has some tax related items. Most appear to be related to church tithing and some property related. Like Ancestry, you’ll need to be creative in searching to find. Try your luck at searching online for historical property tax records in your region of interest or look at a favorite genealogy site. I chose to search for property taxes at the Minnesota Historical Society site. You can view information about their records here. The description from their site: “MNHS has assessment rolls and tax lists for 55 counties. Assessment rolls for real property include the property owner's name; legal land description; building and land values used to provide estimated market value; classification and assessed value of each parcel of property. Assessment rolls for personal property include the property owner's name with assessed value for such items as livestock, jewelry, furniture, household and farm items, and other personal holdings. Tax lists include only summary financial information and indicate the actual amount of taxes paid on each person's real and personal property. The records are arranged chronologically, then alphabetically by political subdivision.” While taxes usually do not have a positive connotation in our lives, when it comes to genealogy, they can be helpful. As we head into tax season, spend some time thinking about your ancestors and the interesting information you can learn thanks to those tax records. In this world, nothing is certain but death and taxes. --Benjamin Franklin

0 Comments

Leave a Reply. |

AuthorWith a lifelong passion for genealogy and history, the author enjoys the opportunity to share genealogy tidbits, inspiring others to research and write their family story. Archives

July 2024

Categories |

RSS Feed

RSS Feed